Simple Global Set-Up in 5 Steps in 2024

🇨🇿 Czech version of the article is here

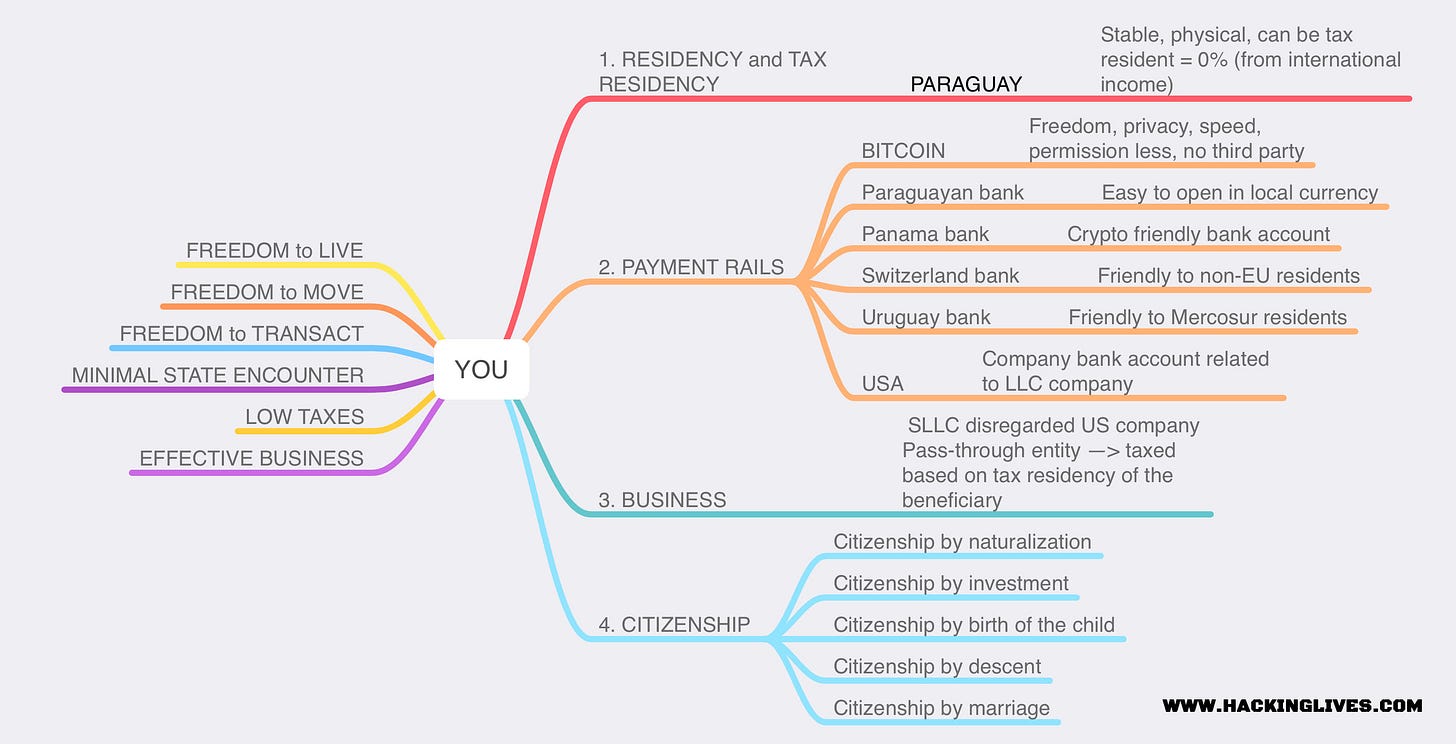

Lately I've been getting a lot of questions about how to create a simple, global and personal structure that is much less prone to potential threats or downsides.

I know it can be quite specific and I can't say in detail what will work for each of you. But let me put together the 101 basic principles and some examples that can serve as a basis for your own reflection.

I must reiterate once again. Do not take this as dogma. There can be many nuances to your own setup and that would require an individual discussion. This is a simple basic configuration where you might want to put your thoughts.

1. Residencies

The first thing you should ask yourself is to what extent you are diversified in terms of residences and citizenships. I don't mean that the more residences and itizenships, the better, but the fact is that a certain number of well-selected residences can give you more options and freedom of movement.

In case of citizenships it is more complicated because they are more difficult to obtain (more expensive in case of CBI or you will pay with your time and effort in case of naturalization. Anyway it should be in your purview and plan to eventually get another citizenship and not just rely on one. But I would jump too far ahead. Let’s re-visit this topic at the end of this article.

The first step should be residency in the country where resident obligations are minimal or nonexistent. It is much easier to get them and often to maintain them. Also, residency is a prerequisite in case of citizenship by naturalization.

Let's look at some examples of residences that meet many of the requirements. You can be very specific depending on your needs/center of life, etc. .... But I consider these residences to be very good value for money (costs/prerequisites/maintenance requirements/low tax countries).

Paraguay - easy to obtain residency, easy to maintain residency. Probably still the best in the world when all costs, prerequisites, maintenance requirements, etc. are taken into account.

Panama - fairly easy to obtain residency, and keep it. But it is a bit more difficult and more expensive compared to Paraguay. Due to more requirements to become a resident (except for Italian citizens who can obtain residency in a simple way on the basis of the Visa treaty).

UAE - "Freelance visa" in free zone is quite cheap, but there is an obligation to regularly visit the territory and extend the visa annually.

There are many other options. The ones mentioned above are simple in many ways. With other residencies you will start to make some compromises. More requirements to keep it (which can be staying in the territory a certain period of time per year) or tougher requirements to obtain it or worse tax conditions.

2. Tax residency

How tax residency works is written here and another article here below.

This depends largely on your lifestyle. If you "live permanently in a backpack", then it is wise to select the tax residence with 0%. One of the examples can be Paraguay or Panama.

If you do not live in the backpack. It may be convenient to live half a year in the mentioned countries in order to have tax residence there and benefit from 0% international income tax.

If you are thinking about this I would start researching Paraguay as step number one due to the 0% international income tax + it is one of the cheapest ways to obtain and maintain residency in Paraguay. More on this topic in this article. You will understand the benefit of it later in the article.

3. Banks

This is perhaps the most complicated issue that is part of the whole diversified plan. Unfortunately, banks are governed by their own rules. And they are a pain in the ass.

Banks should be step #3 after you have your physical and tax residency sorted out. The advantage is that you will be able to open bank accounts in other countries where you might have problems with your previous residence, now you can diversify in terms of bank accounts and disclose to them your new tax residence (where banks will report).

Some popular countries where to open bank accounts could be:

Panama - crypto friendly bank

USA - never signed CRS even though they initiated it

Paraguay - for local life and use, never signed CRS

Uruguay - good banking services, possible to open a bank account as non-resident but Mercosur country resident.

Switzerland - opened banking system even for residents outside EU.

Gibraltar - Xapo bank - bitcoin friendly bank.

Revolut fintech - you don’t need to disclose tax residency (in case of Paraguayan tax residents as Paraguay does have 0% tax on international income. This is the direct info from Revolut when I was talking to them).

4. Bitcoin

We mentioned banks in the previous paragraph. And it is important to mention bitcoin now. Banks have a lot of drawbacks. In their overall setup bitcoin definitely has its place. And now I'm not talking about store of value. I'm talking about the freedom to transact. Where banks are failing bitcoin is strong.

If you have not had any experience with "flagged" or "frozen" wire transfers, you are probably a lucky person. Sooner or later it will happen, especially with international transfers. Banks are expensive dinosaurs with so many inconveniences, regulations, privacy interventions and they complicate everything.

I suggest limiting the banking sector as much as possible in private or commercial transactions. Anywhere it is possible. Bitcoin provides privacy, reliability and permissionless transfers.

If you are new to the bitcoin world, try to study the basics and embrace this technology. You will later realize that the banking system will not be the first but the last solution and will only be used when it is not possible to use bitcoin or cash transfers.

I want to clarify that we are talking about everything 100% legal. Even if you do everything legally, everything according to the law, banks are still a pain in the ass. They don't help to make things easy and simple. And to be able to limit this "bullying" from banks is smart to move to the system where you can transfer money without anyones permission.

Bitcoin - money that can't be stopped or confiscated

There are a lot of articles on bitcoin and it could take a lifetime to read them all. I want to look at bitcoin from another perspective and that is how it can work as unstoppable money. Especially for all of you who often travel, live in multiple jurisdictions and how bitcoin can help you circumvent the pain of using the regular banking sector.

5. Business

I think some of you are entrepreneurs or businessmen. This should be step #5. You need a company based in the country that has signed a double tax treaty. For tax residents in the country with the territorial taxation system, USA is the country to go to set-up company. Note: does not apply to US citizens/residents.

Set-up an SLLC (single member LLC company) that acts as disregarded company in front of IRS. Meaning that company acts as pass through entity and all incomes are taxed based on tax residency of the beneficiary. In this case you have income without taxes when your tax residency is in territorially taxed country. You are welcome.

There are some caveats to that but you can read more here.

6. Citizenships

When you have your residencies set-up you can start to think about citizenships as a step forward in the future. In case of citizenships you can read more in this article. If you cannot obtain citizenship by descent or by marriage, then you are left with 3 other popular options which are citizenship by investment (CBI), citizenship by naturalization or citizenship based on the birth of your child.

Citizenship by naturalization - you are left with countries that effectively require low presence in the country (around 2 - 3 years to be eligible), plus you should enjoy living in the country. Because you will have to relocate and physically live in the country. There are no workarounds.

These countries can be - Argentina, Paraguay, Dominican republic, Peru

Citizenship by investment - you pay money (a kind of gift to the country or you have to invest in real estate usually double the “gift” amount). In general, you shorten the process with money instead of investing time. There are several CBI programs. They require only an investment and often no visit. Of course, these passports are not as good compared to those of other countries, but they do the job.

These countries can be - Antigua & Barbuda, Dominica, Grenada, St.Kitts & Nevis, Santa Lucia, Malta…

The last one is citizenship by birth of the child. In some countries it is possible to acquire citizenship shortly after the baby is born. It is only applicable in countries based on the "jus soli" system and the fastest way to citizenship for non-citizen parents offers Brazil.

To wrap it up

These are the 3 main steps you should take into account to get started:

Residency and tax residency

Using Bitcoin and have certain amount of bank accounts distributed across the world

Business entity

If you are tighter on a budget this set-up below might be a great start for you:

Residency - Paraguay (1 day visit in Paraguay to start the process). Cheap and almost no requirements to maintain residency through years.

Tax residency - Paraguay (You can register with the Tax office.)

Bitcoin - learn how bitcoin works and start using it. Leverage the self-sovereignty. Try to minimize your exposure in the FIAT system. Bitcoin is more reliable, faster, cheaper and permissionless. You can get money from one side of the world to another in seconds. In case of larger amounts in minutes. Without fear of any regulatory body causing problems. Have you tried to make a bank transfer from Europe to Latin America? If your answer is yes, then I think you probably know bitcoin.

Banks - various banks to not putting all eggs in one basket. Depending on your personal preference. But USA, Swiss, Uruguay and Panama are generally good choices in the this “bad” segment.

Business - Set-up SLLC in the US and run all non-US clients from this LLC.

Later you can explore other topics such as citizenships (which take longer or are more expensive).

You can explore where to invest. You can read the article about the real estate market in Paraguay. But it can be anything else. Just keep in mind your personal setup, what you are trying to solve and what kind of "insurance or protection" you are looking for.

I hope it has helped you to better understand this topic. You can set up these steps in no time. You can do in 2 months and get more free and a better life.

Links:

Sign up for the blog and don’t miss new information

Did it help or do you like it? You can send some satoshis (smallest unit of bitcoin) to satoshis@walletofsatoshi.com